new jersey 529 plan deduction

New Jersey 529 tax deduction. This feature starts in 2022.

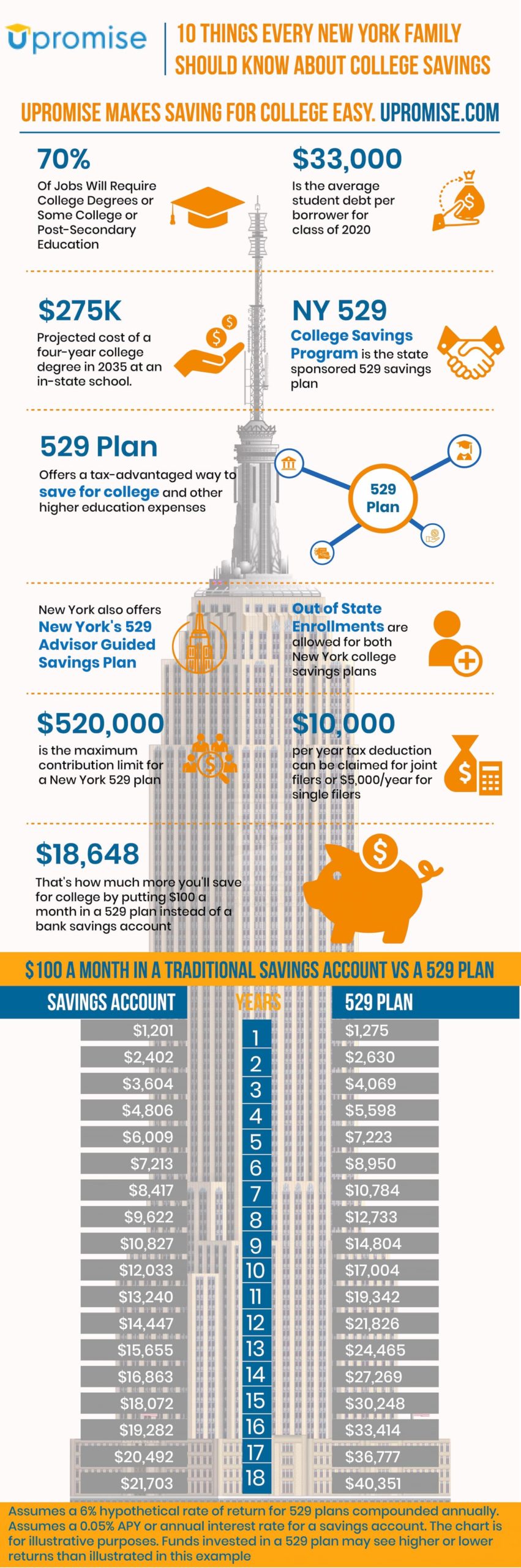

529 Plan New York Infographic 10 Facts About Ny S 529 To Know

Tax Deductions for New Jersey Families Unlike traditional IRAs and 401ks 529 plan contributions are not tax deductible at the federal level.

. New Jersey Provides Tax Deduction for College Savings Plan Contributions By Ralph Loggia CPA MST Goldstein Loggia CPAs LLC December 14 2021 Many states. Unfortunately New Jersey does not offer any tax benefits for socking away funds in a 529. As of January 2019 there are no tax deduction benefits when making a contribution to a 529.

NJ residents can claim a tax deduction for contributions to a NJ 529 plan. You must have a gross income of 200000 per year. Thanks to recent legislation.

NJBEST 529 College Savings Plan is a traditional NJ 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified education expenses. New Jersey taxpayers with gross income of 200000 or less may qualify for a state income tax deduction for contributions into an. Contributions to such plans are not deductible but.

Contributions are deductible in computing state taxable income 529 plan contributions grow tax-free. Now New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayer for contributions to the plan. If you earn less than 20000 per year you are eligible for a tax deduction for contributions of up to 10000.

What happens to a New Jersey 529 Plan if not used. Section 529 - Qualified Tuition Plans. In New Mexico families can deduct 100 of their contributions to.

New Jersey taxpayers with gross income of 200000 or less may qualify for a state income tax deduction for contributions into an NJBEST plan of up to 10000 per taxpayer per year. Is a 529 plan tax deductible in the state of New Jersey. New Jersey does not provide any tax benefits for 529 contributions.

New Jersey will offer a state tax deduction of up to 10000 per taxpayer per year for contributions to a New Jersey 529 plan. Managed and distributed by Franklin. New Jersey taxpayers with a gross income of 200000 or less may qualify for a state income tax deduction for contributions into an NJBEST plan of up to 10000 per taxpayer per year.

Many states provide an income tax deduction for contributing to a college savings plan including New York which provides a maximum annual 10000 deduction. State tax deduction or credit for contributions. A 529 plan is designed to help save for college.

NJBEST New Jerseys 529 College Savings Plan is offered and administered by the New Jersey Higher Education Student Assistance Authority HESAA. New Jersey offers tax benefits and deductions when savings are put into your childs 529 savings plan. No New Jersey does not offer tax deductions for 529 plans.

Section 529 - Qualified Tuition Plans. New Jerseys plan doesnt offer much. The plan NJBEST is offered through Franklin Templeton.

When Choosing Funds For Your College 529 Plan Don T Make This Mistake Kiplinger

Njbest 529 On Twitter A State Tax Deduction Of Up To 10 000 Is Now Allowed For New Jersey Taxpayers With A Gross Income Of 200 000 Or Less As A Result Of The

New Tax Breaks For Nj College Students Senior Citizens What To Know

New Jersey 529 Plan And College Savings Options Njbest

What Are The 529 Plan Contribution Limits For 2022 Smartasset

Nj College Affordability Act What You Need To Know Access Wealth

New Tax Law Allows Affluent Taxpayers To Write Off K 12 Private School Tuition Itep

How Much Are 529 Plans Tax Benefits Worth Morningstar

How Much Are 529 Plans Tax Benefits Worth Morningstar

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

/collegeadvantage-logo-a6b3e93e48f6442eb74a7f38afccef30.png)

Best 529 Plans For College Savings

529 Plan Tax Benefits State By State Breakdown Silver Tax Group

10 Things Parents Should Know About College Savings

Kansas 529 Plans Learn The Basics Get 30 Free For College Savings

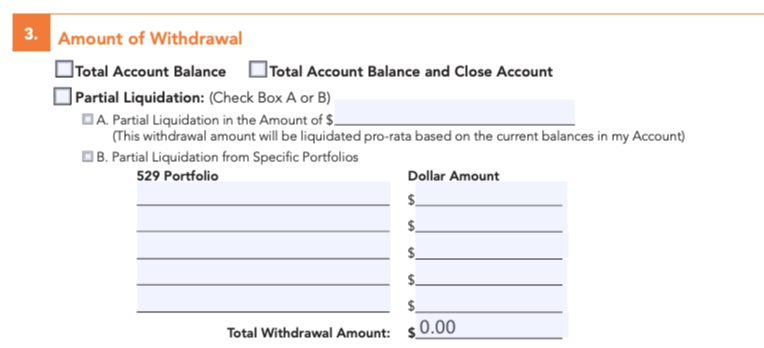

529 Plan Withdrawal Rules How To Take A Tax Free Distribution